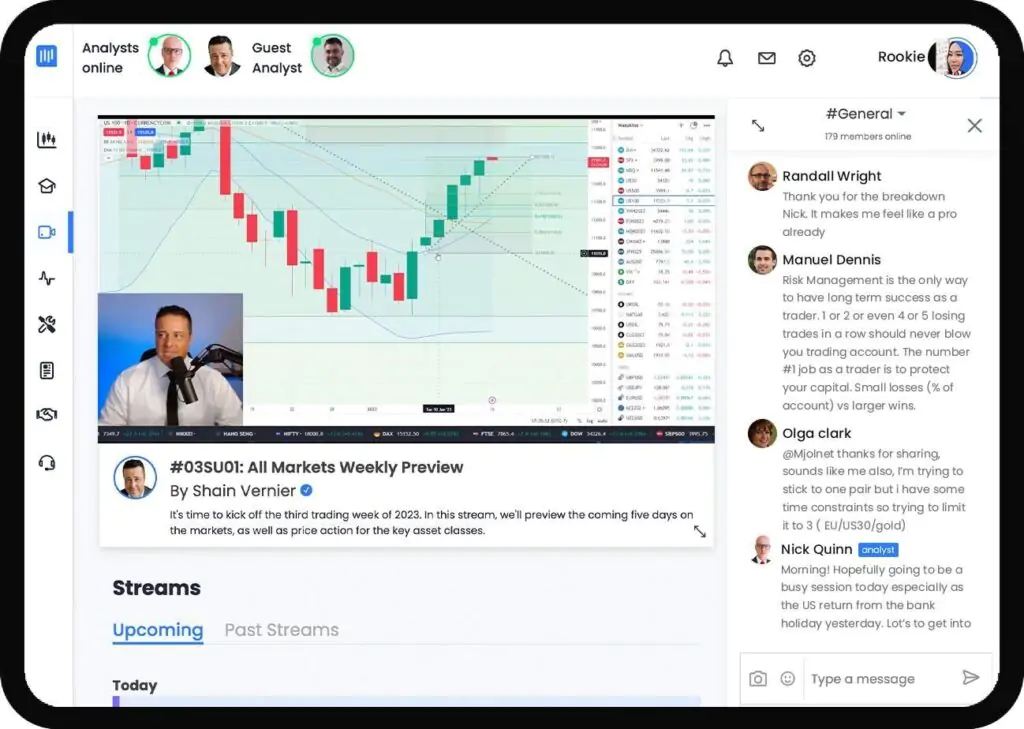

Trading Room

What’s covered in HowToTrade’s live streams?

- Never guess what to trade again - we analyse Forex, Stocks, Commodities, Futures, Options, Crypto and much more with you

- Get clarity on what moves the markets - we breakdown fundamental analysis so you can find your own trade opportunities

- Stop being confused by economic jargon - we'll show you how inflation, interest rates, employment stats and more impact your trading

- Key learnings for everyone - no matter your experience, we cover the basics up to the most advanced technical analysis

- Look at charts in a fresh way - let us show you the simplest and smartest way to read, understand and execute on charts

- Learn to create your own trading strategy - use our backtested strategies or let us share the knowledge of how to build your own

- Master your trading mindset - the most important topic, we'll help you craft the emotions needed to be a trader - don't make the same mistakes most traders do

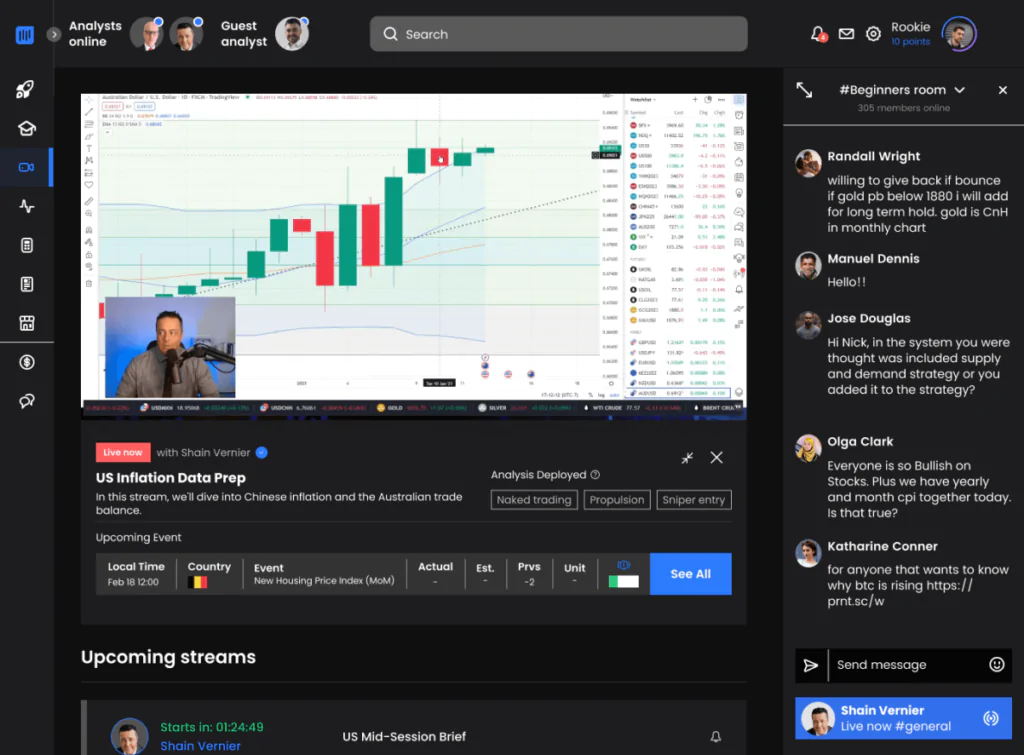

Very important detail, How to trade in addition to being a trading room, it is also a prop trading firm and has a great plan

A trading room is a physical or virtual space where financial market participants such as traders, brokers, and analysts buy and sell securities such as stocks, bonds, currencies, commodities, and derivatives. The goal of a trading room is to facilitate the buying and selling of securities in a fast and efficient manner, using cutting-edge technology and real-time market data.

Trading rooms typically include computer terminals, market data displays, and communication systems that allow traders to receive real-time market data, execute trades, and manage risk. Some trading rooms also have audio and video systems for inter-office communication, as well as areas for collaboration and strategy development.

Trading rooms can be located in financial institutions such as investment banks, hedge funds, and asset management firms, and they are typically staffed by experienced traders and support personnel. In recent years, advances in technology have enabled the creation of virtual trading rooms that can be accessed from anywhere in the world, providing greater flexibility and cost savings for market participants.

It is important to note that the activity in a trading room can have a significant impact on the financial markets, as the decisions made by traders and market participants can result in large trades that can move prices and affect market sentiment.

Trading rooms are usually fast-paced and highly competitive environments, where traders work under pressure to make quick and informed decisions. Traders in a trading room must have a good understanding of financial markets and the economic and political events that can impact market prices. They also need to be able to analyze market data and make trades based on that information, often using specialized trading software and algorithms.

Traders in a trading room are typically divided into teams, each with a specific area of focus, such as equities, fixed income, or commodities. Teams work together to make decisions and execute trades, and they also compete with each other to generate the best returns for their firms.

Trading rooms are subject to strict regulations, as the activities that take place in them can have a significant impact on the financial markets. Regulators monitor the activities of trading rooms to ensure that traders follow ethical and legal guidelines and do not engage in practices that could harm the markets or investors.

In addition to traditional trading rooms, there are also virtual trading rooms that use technology to connect traders from different locations in real-time. These virtual trading rooms offer many of the same features and benefits as traditional trading rooms, but they are less expensive to set up and operate and provide traders with greater flexibility to work from anywhere.

In conclusion, trading rooms play a crucial role in the financial markets, as they provide the infrastructure and resources needed to facilitate the buying and selling of securities. They are fast-paced and competitive environments, and traders must be able to make quick and informed decisions in order to be successful. Trading rooms are subject to strict regulations, and advances in technology have made virtual trading rooms increasingly popular.

In modern trading rooms, technology plays a significant role in enabling traders to make informed decisions quickly and accurately. Trading rooms are equipped with high-performance computers, multiple monitors, and real-time market data feeds to provide traders with up-to-date information on market prices, volumes, and trends.

Traders in trading rooms use various software tools to analyze market data, execute trades, and manage risk. For example, they may use charting software to visualize market trends and price movements, or they may use algorithmic trading software to execute trades based on predetermined rules and conditions.

In virtual trading rooms, traders use collaboration and communication tools such as video conferencing, instant messaging, and file sharing to work together as if they were in the same physical location. This enables traders from different parts of the world to collaborate and share information in real-time, regardless of their location.

Another important aspect of trading rooms is risk management. Traders in trading rooms must be able to assess and manage the risk associated with their trades. They use various risk management tools and techniques to limit their exposure to losses, such as stop-loss orders and position sizing strategies.

In addition to the technical skills required of traders, it is also important for them to have good communication and interpersonal skills. Traders in trading rooms need to be able to work effectively in teams and communicate with each other, as well as with clients and market participants.

In conclusion, trading rooms are an integral part of the financial markets, where traders buy and sell securities in real-time. The technology and tools available in modern trading rooms enable traders to make informed decisions quickly and accurately, while also managing risk. In virtual trading rooms, traders are able to collaborate and communicate with each other, regardless of their location.

Conditions

Newsletter

DISCLAIMER: Futures, forex, stocks and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks and options may fluctuate, and, as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will have a great impact on your trading account and this can work against you, leading to large losses or can work for you, leading to large gains.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.